ohio sales tax exemption form 2019

Complete Form 532 and pay the 125 filing fee to become an Ohio corporation under your name sending the signNowwork to the Secretary of State. Therefore you can complete the Ohio sales tax exemption certificate form by providing your Sales Tax Number.

Printable Ohio Sales Tax Exemption Certificates

573902B42g provides an Ohio sales tax exemption when the purpose of the purchaser is to use the thing transferred primarily in a manufacturing operation to produce tangible personal.

. To check on your refund pay your taxes or file online visit TaxOhiogov. The Ohio state sales tax rate is 575 and the average OH sales tax after local surtaxes is 71. Farmers have been exempt from Ohio sales tax on purchases used for agricultural production for several decades.

A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making sales-tax-free purchases. Click here for specific instructions regarding opening and using any of our pdf fill-in forms if you are a Windows 10 user. The Ohio Department of Taxation will help you find answers to questions about Ohio income taxes including who needs to file a return how and when to file finding the right tax forms and information about Ohios sales tax holiday.

Currently Ohio sales tax is charged on all sales of tangible personal property and services unless there is an exception to this tax. Thats because Ohios sales tax law is a bit tedious and complicated. Sale Tax Exemption Form Simple Online Application.

Written by Peggy Kirk Hall Associate Professor Agricultural Resource Law. Ohio sales tax blanket exemption form 2019. Ohio tax exempt form pdf.

The Ohio sales tax exemption for manufacturing is broad and encompasses a wide array of purchases used in the manufacturing process. Call You may call to speak with an examiner at 1-800-282-1780 during the Departments normal. Youll need to describe your groups activities in the application.

Since the majority of exceptions or. Enter a full or partial form number or description into the Title or Number box optionally select a tax year and type from the drop-downs and then click the Search button. Ohio Revenue Code Ann.

Ohio has 1424 special sales tax jurisdictions with local sales taxes in addition to the. In Ohio certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers. The Ohio sales and use tax applies to the retail sale lease and rental of tangible personal property as well as the sale of selected services in Ohio.

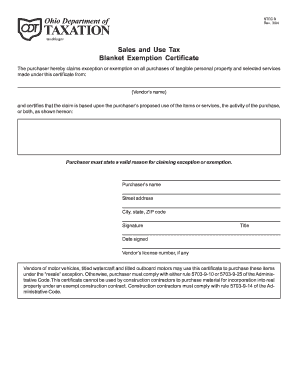

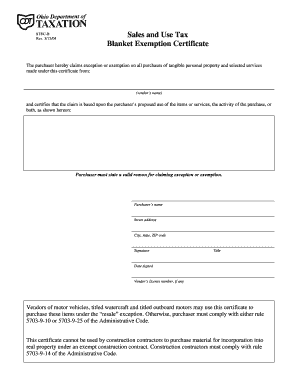

Sales and Use Tax Unit Exemption Certifi cate The purchaser hereby claims exception or exemption on all purchases of tangible personal property and selected services made under this certifi cate from. Sales tax exemption in the state applies to certain types of food some building materials and prescription drugs. Vendors name and certifi or both as shown hereon.

Counties and cities can charge an additional local sales tax of up to 225 for a maximum possible combined sales tax of 8. Obtain an Ohio Vendors License. Groceries and prescription drugs are exempt from the Ohio sales tax.

Ohio unit tax exemption certificate. Complete Form 532 and pay the 125 filing fee to become an Ohio corporation under your name sending the paperwork to the Secretary of State. You will need to present this certificate to the vendor from whom you are making the exempt purchase - it is up to the vendor to verify that you are indeed qualified to make a tax.

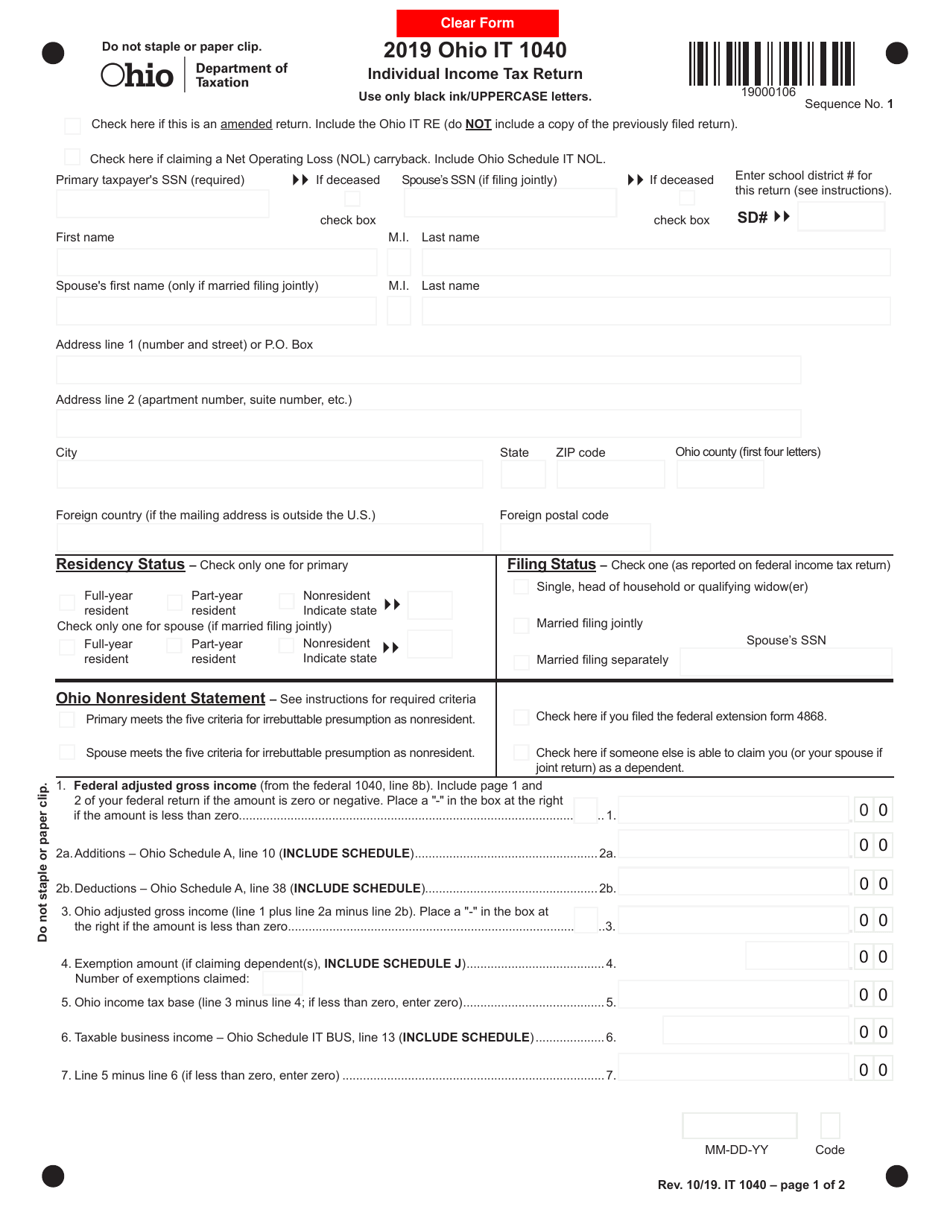

Sales and Use Tax Blanket Exemption Certificate. Counties and regional transit. 2019 Ohio IT 1040 SD 100 Instructions Email Click Contact at the top right on taxohiogov and select Email Us to access a secure email form.

Ohio tax exempt form pdfke smartphones and tablets are in fact a ready business alternative to desktop and laptop computers. How to use sales tax exemption certificates in Ohio. Online at taxohiogov Mobile App - Search Ohio Taxes on your devices app store.

The purchaser hereby claims exception or exemption on all purchases of tangible personal property and selected services made under this certifi cate from. Vendors name and certi fi es that the claim is based upon the purchasers proposed use of the items or services the activity of the. Mail this form to the IRS and then wait to receive proof of tax exemption.

Ohio sales tax blanket exemption form 2020. Many states have special lowered sales tax rates for certain types of staple goods - such as groceries clothing and medicines. Sales Tax Exemptions in Ohio.

Online at taxohiogov Mobile App - Search Ohio Taxes on your devices app store. Fill out the Ohio sales tax exemption certificate form. This form may be used in conjunction with form REV-1715 Exempt Organization Declaration of Sales Tax Exemption when a pur- chase of 200 or more is made by an organization which is registered with the PA Department of Revenue as an exempt organization.

Mail this form to the IRS and then wait to receive proof of tax exemption. The state sales and use tax rate is 575 percent. Ohio sales tax exemption for manufacturing.

You can take them everywhere and even use them while on the go as long as you. Farming is one of the exceptions. If youve ever claimed a sales tax exemption on a purchase of farm goods you may have experienced some confusion over whether you or the good is eligible for the exemption.

Ohio sales tax exemption form 2020. 2019 Ohio IT 1040 SD 100 Instructions Email Click Contact at the top right ontaxohiogov and select Email Us to access a secure email form. Call You may call to speak with an examiner at 1-800-282-1780 during the Departments normal business.

Ad STF OH41575F More Fillable Forms Register and Subscribe Now. Ohio Revised Code RC section 573901FFF. Ohio tax exempt form for farmers.

Tax-exempt form ohio non profit. Ad Sale Tax Exemption Form Wholesale License Reseller Permit Businesses Registration. Once you have that you are eligible to issue a resale certificate.

This change results in the exemption of the sale of corrective eyeglasses and contact lenses pursuant to a prescription from sales and use tax on or after that date. However this does not make all purchases by farmers exempt. In transactions where sales tax was due but not collected by the vendor or seller a use tax of equal amount is due from the customer.

Ad Download Or Email STEC B More Fillable Forms Register and Subscribe Now. October 13 2021. Ohio sales tax blanket exemption form 2019.

Purchaser must state a valid reason for claiming exception or exemption. Ohio tax exempt form for farmers. Ohio sales tax exemption form 2020.

How To Get A Sales Tax Exemption Certificate In Ohio Startingyourbusiness Com

2015 2022 Oh Stec B Formerly Stf Oh41575f Fill Online Printable Fillable Blank Pdffiller

Sales And Use Tax Unit Exemption Certificate Zephyr Solutions Llc

Form It1040 Download Fillable Pdf Or Fill Online Individual Income Tax Return 2019 Ohio Templateroller

How To Get A Sales Tax Certificate Of Exemption In Virginia Startingyourbusiness Com

Fill In Blank Tax Exemption Form Ohio Fill Online Printable Fillable Blank Pdffiller

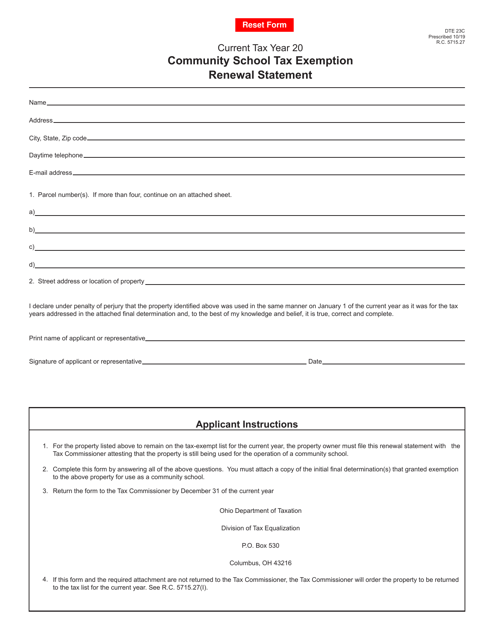

Form Dte23c Download Fillable Pdf Or Fill Online Community School Tax Exemption Renewal Statement Ohio Templateroller

New Bulletin Explains Ohio S Sales Tax Exemptions For Agriculture Farm Office

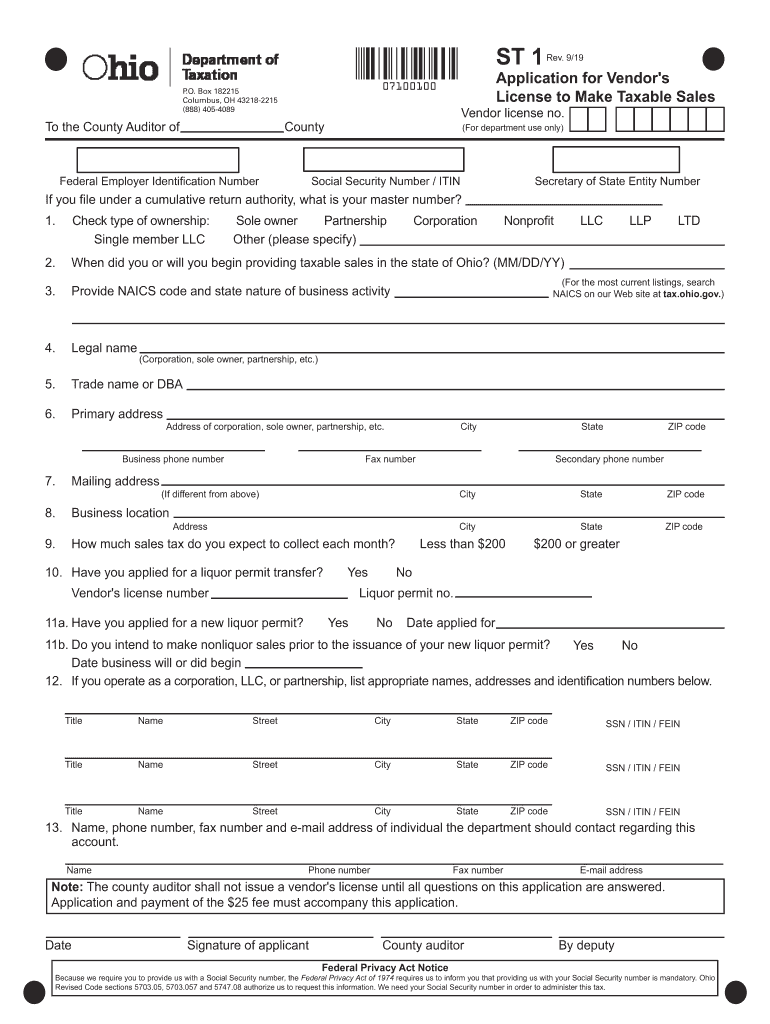

Oh St 1 2019 2022 Fill Out Tax Template Online Us Legal Forms

Tax Exempt Form Ohio Fill Out And Sign Printable Pdf Template Signnow

Doing Business With Us Concrete Material Supply

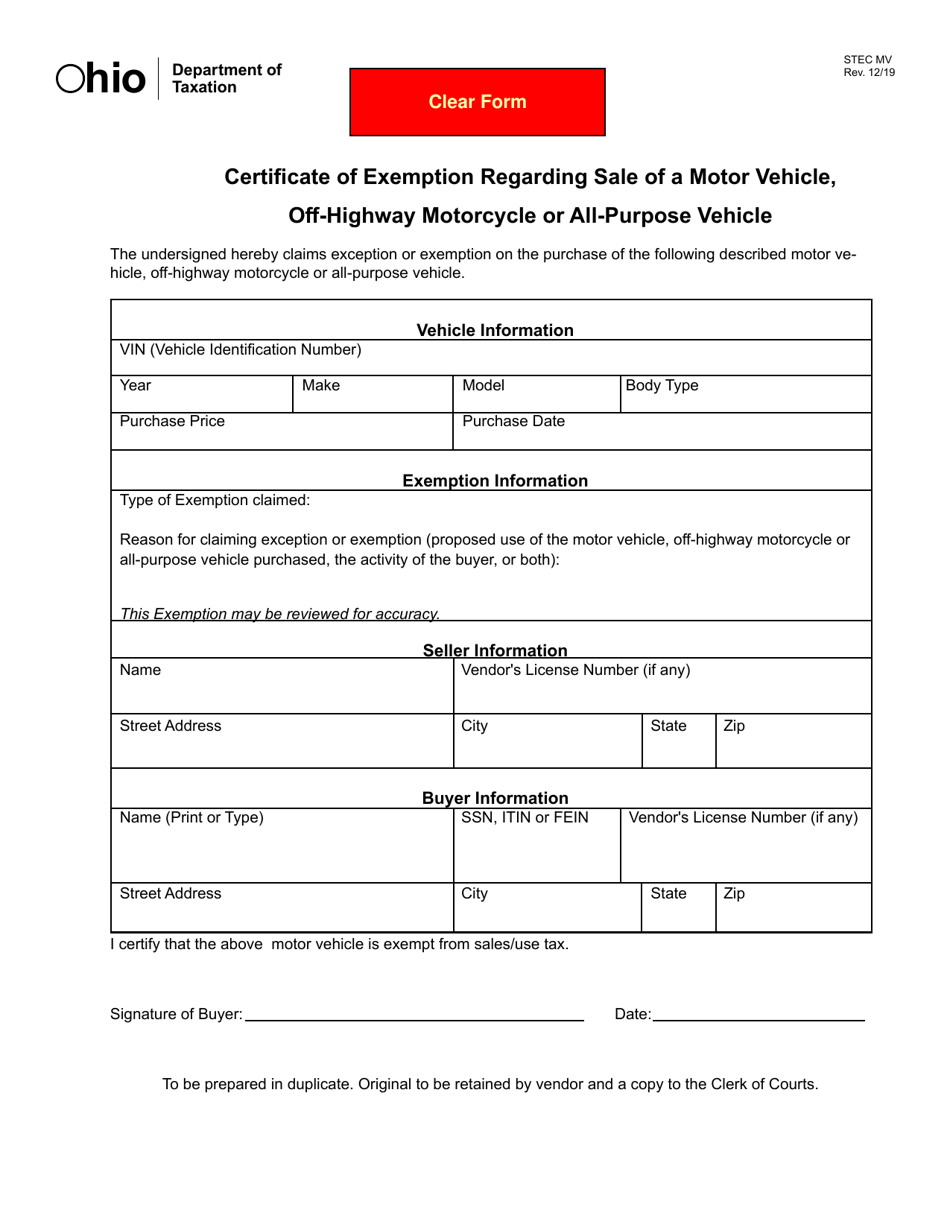

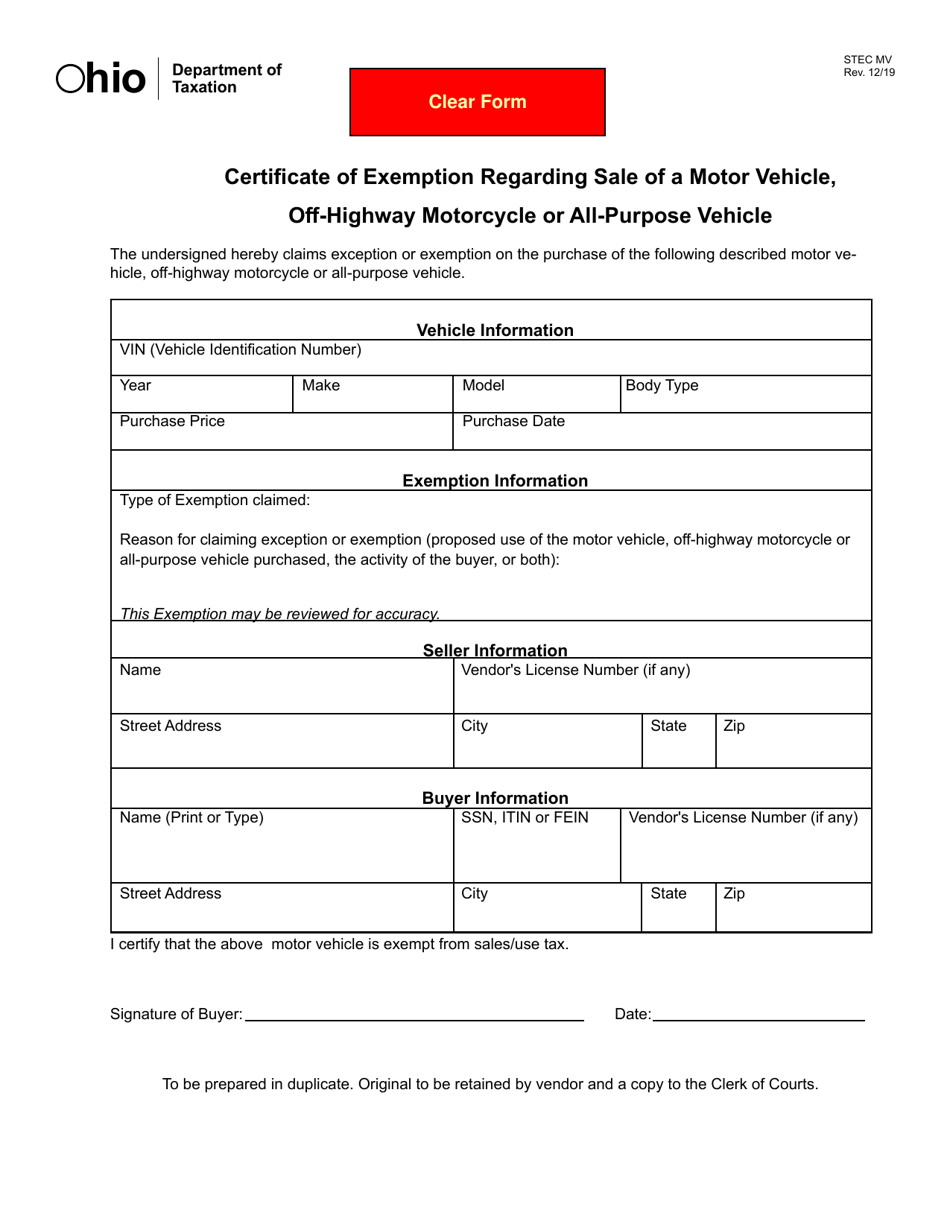

Form Stec Mv Download Fillable Pdf Or Fill Online Certificate Of Exemption Regarding Sale Of A Motor Vehicle Off Highway Motorcycle Or All Purpose Vehicle Ohio Templateroller

Fill In Blank Tax Exemption Form Ohio Fill Online Printable Fillable Blank Pdffiller

Fill Free Fillable Forms State Of Ohio

Oh Stec Co 2014 2022 Fill Out Tax Template Online Us Legal Forms

Fill Free Fillable Forms State Of Ohio